NEW TAX BENEFIT FOR 2022 TAX YEAR

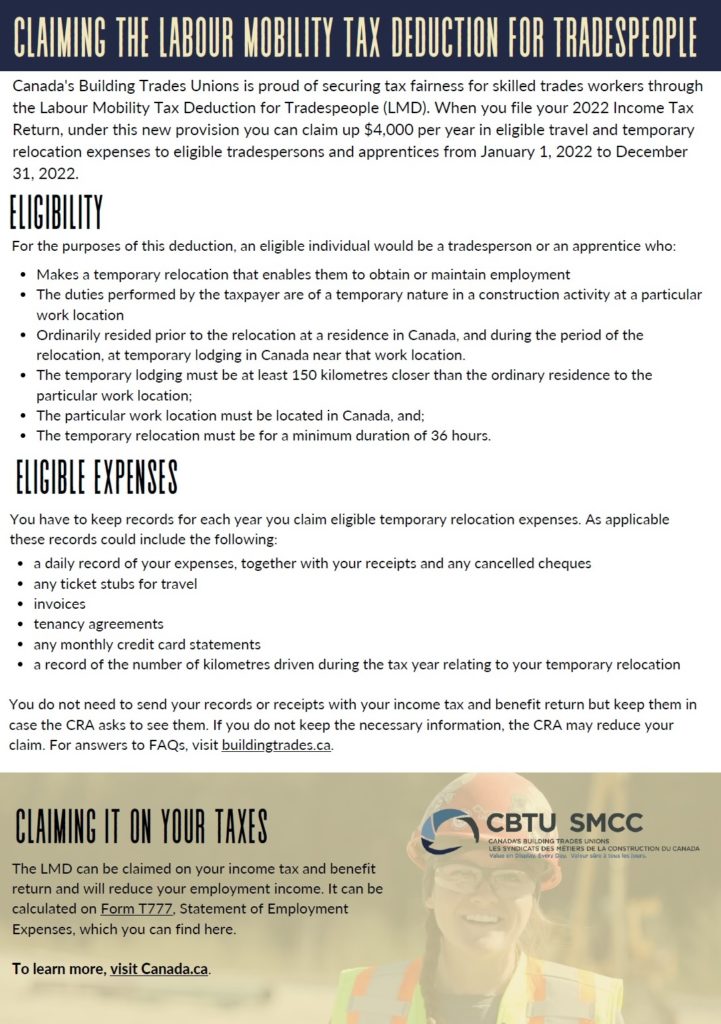

Budget 2022 included a historic win for Canada’s skilled trades workers with the inclusion of the Labour Mobility Tax Deduction for Tradespeople. The deduction provides tax recognition on up to $4,000 per year in eligible travel and temporary relocation expenses to eligible tradespersons and apprentices. This tax deduction applies retroactively to eligible out-of-pocket long-distance travel receipts from January 1, 2022.

Tax Deduction Webinar

BDO Canada Tax Partner Lorenzo Bonanno joined CBTU for a webinar on Claiming the Labour Mobility Tax Deduction on February 9, 2023. You can read and download his full presentation here. You can watch a recording of the webinar below.

FAQs

What is the tax deduction?

The Labour Mobility Deduction provides eligible tradespeople and apprentices working in the construction industry with a deduction for certain relocation expenses. To qualify for the labour mobility deduction (LMD), you must be an eligible tradesperson who had an eligible temporary relocation and incurred temporary relocation expenses.

This deduction applies to the 2022 and subsequent taxation years and allows an eligible tradesperson to deduct up to $4,000 in eligible temporary relocation expenses per year, starting January 1, 2022. The maximum amount of temporary relocation expenses that could be claimed for a particular eligible temporary relocation is limited to 50% of the eligible tradesperson’s employment income from construction activities at the eligible temporary work location in the year.

Who is eligible?

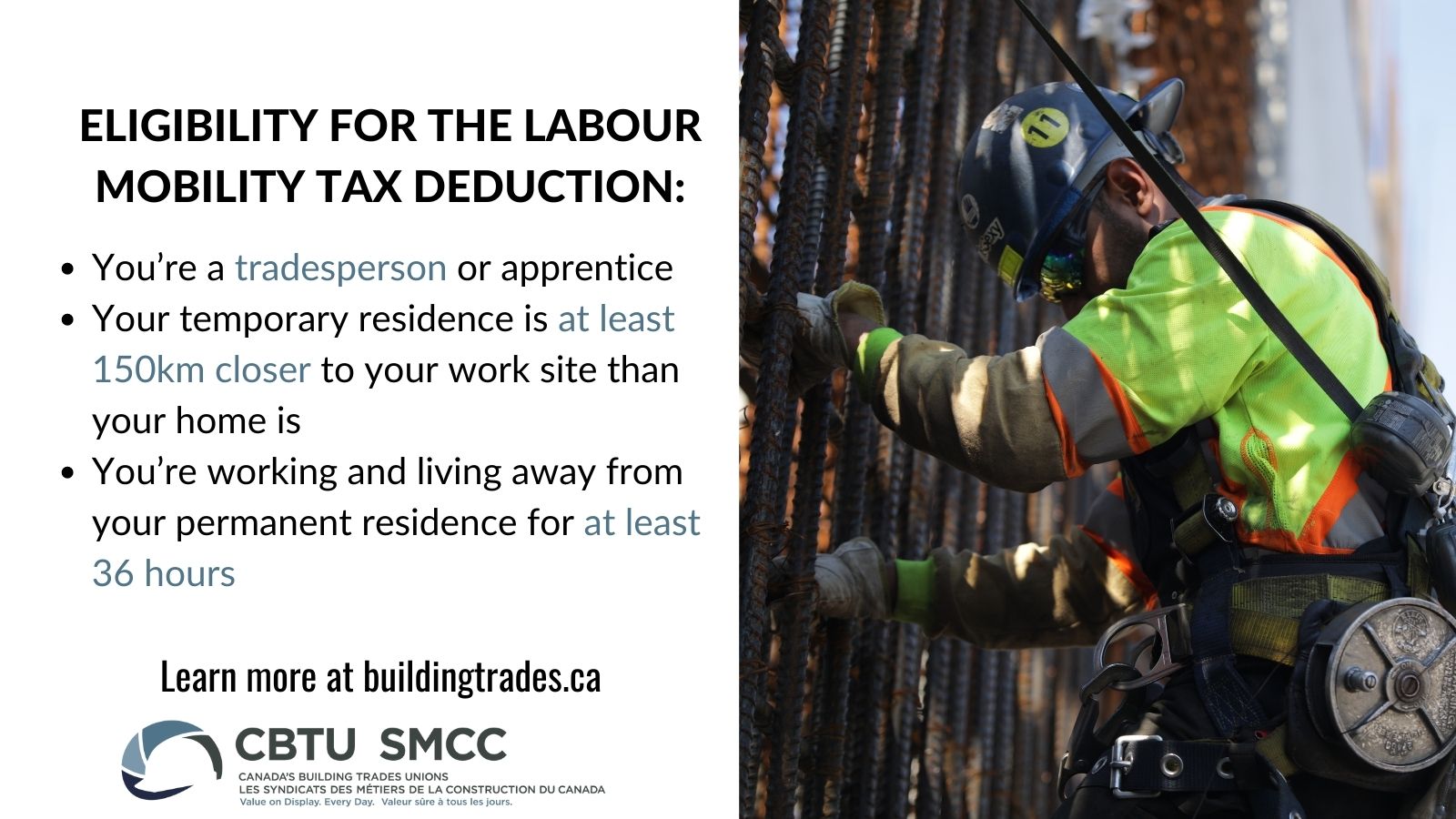

An eligible tradesperson is a tradesperson or an apprentice who:

- has income from employment

- performs their duties of employment in construction activities

Construction activities include the erection, excavation, installation, alteration, modification, repair, improvement, demolition, destruction, dismantling or removal of all or any part of a building, structure, surface or sub-surface construction, or any similar property.

What is an eligible relocation?

To qualify as an eligible temporary relocation the relocation must be temporary in nature and meet all of the following conditions:

- the relocation is undertaken by the eligible tradesperson to enable them to perform their duties of employment as an eligible tradesperson at one or more temporary work locations situated in the same locality

- prior to the relocation the eligible tradesperson ordinarily resided at a residence in Canada

- the eligible tradesperson was required to be away from their ordinary residence for at least 36 hours

- during this period, the eligible tradesperson took up temporary lodging in Canada

- the distance between the eligible tradesperson’s ordinary residence and the temporary work location must be not less than 150 kilometres greater than the distance between each temporary lodging and each temporary work location of the taxpayer

How do I claim the deduction?

Save your eligible receipts and file the claims – or have your accountant file the claims – along with the rest of your tax return at the end of the fiscal year.

To make a claim for the Labour Mobility Deduction complete the calculation found on page 2 of tatement of Employment Expenses. The amount you calculate, will be entered on page 1, line 11 of the form T777.

Can I claim both the LMD and eligible moving expenses?

No, in order to be considered eligible temporary relocation expenses, the expenses must not be deducted by the taxpayer, in any taxation year, for purposes other than the LMD.

Can I claim my expenses as part of my Labour Mobility Deduction total and as separate line items (i.e T777 line 3 for motor vehicle expenses)?

No, you can only claim expenses in one portion of your tax filing. Travelling tradespeople should claim their out-of-pocket travel expenses on Labour Mobility Tax Deduction – line 11 of the T777.

Can I claim expenses on multiple jobs?

Yes, if you were employed for multiple jobs that required you to relocate then you can claim expenses for each eligible temporary relocation. For example, Joe is from Sarnia. He spent six months in 2022 working on a project in Thunder Bay and six months working on a project in Calgary. Joe would be able to claim eligible expenses (up to $4,000) for each of those projects.

My employer reimbursed me for a portion of my temporary relocation expenses, but it wasn’t enough to cover my expenses. Can I claim the out-of-pocket portion?

Yes. For example, Sally’s round-trip flight to her eligible temporary work location cost her $1,400, but her employer only reimbursed her for $1,000. Sally could claim the $400 that she paid out of pocket as part of her total expenses under the Labour Mobility Deduction.

Do I need to fill out a T2200 to claim the Labour Mobility Deduction?

No, CRA has confirmed the T2200 is not required for this deduction and are working with tax software developers to ensure it’s reflected in their programs.

These materials are for information purposes only. Please comply with the Canada Revenue Agency’s policies and for further information consult the CRA or a professional accountant.

Help make skilled tradespeople across Canada aware of this policy change by sharing our materials.